Introduction

Small businesses in Canada are increasingly turning their attention to new strategies for managing credit card processing. Among these strategies, dual pricing stands out as a noteworthy trend gaining traction across various sectors. This approach, of offering both cash and credit prices, while not entirely new, has seen renewed interest due to its potential benefits and adaptability in today’s market dynamics.

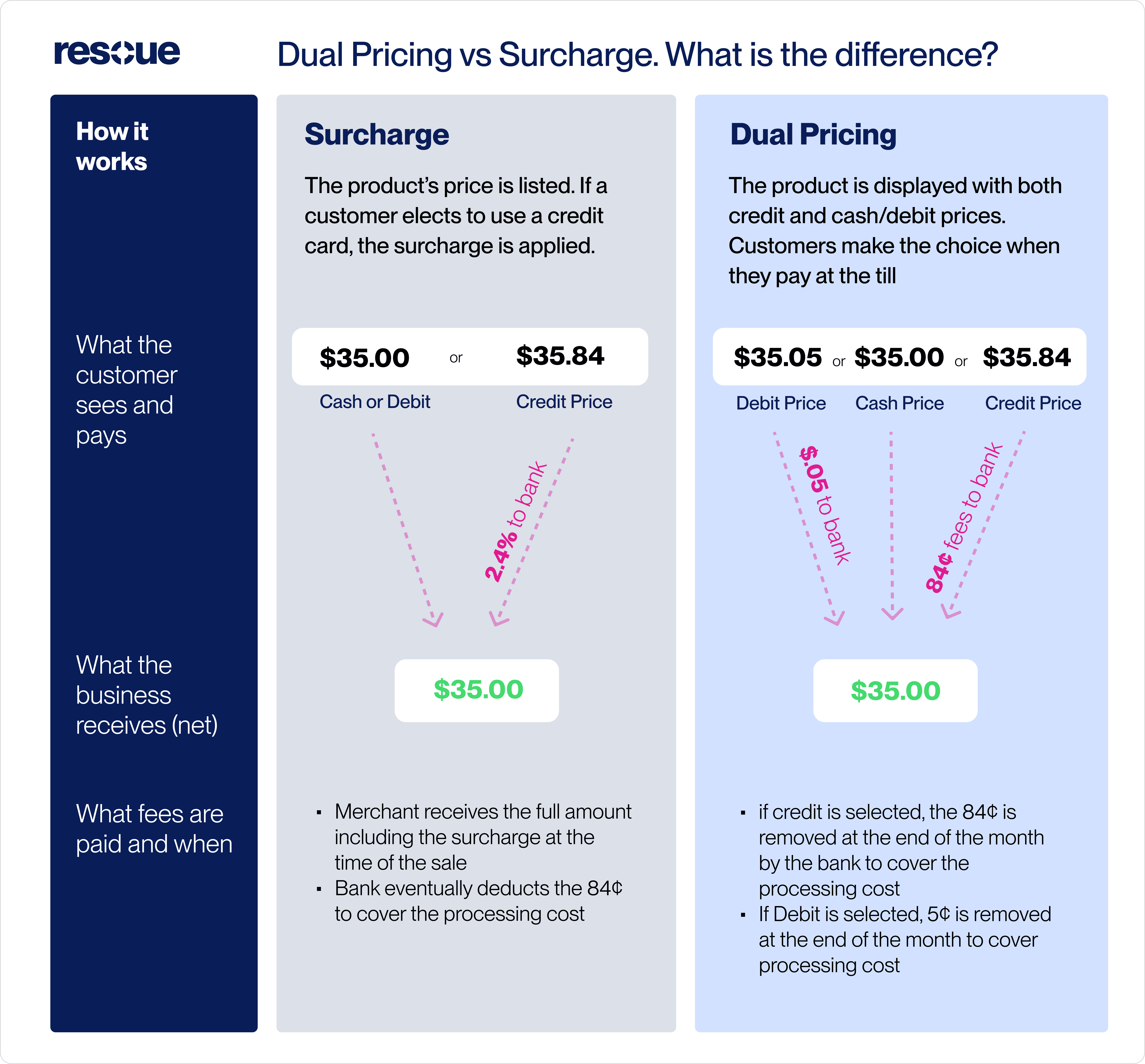

Here is how Dual Pricing differs from Surcharge

TL;DR: Dual pricing is an effective strategy for Canadian small businesses looking to manage credit card processing costs. By posting and offering separate price points for cash and credit transactions, businesses can offset the higher fees associated with credit card payments, encouraging customers to pay with cash or debit for a discount. Unlike surcharge, dual pricing clearly shows a reduced price for debit and cash payments versus credit card payments. This model promotes cost efficiency, transparency, and flexibility, offering customers clear choices and elimination credit card transaction costs for the business. Implementing dual pricing requires careful planning, including understanding legal regulations, upgrading POS systems for seamless transactions, and ensuring clear communication with customers about pricing differences. While dual pricing provides significant benefits like reduced processing fees and enhanced customer satisfaction, it’s essential to consider your customer base, transaction volumes, and competitive landscape to determine if it’s the right strategy for your business.

The Rise of Dual Pricing in Credit Card Processing

Dual pricing in credit card processing is a model where businesses set two distinct price points for their goods or services: one for customers who pay with cash and a slightly higher one for those who opt for credit card payment. This method has become more prominent in Canada as businesses find ways to navigate the increasing costs associated with credit card transactions. By implementing dual pricing, businesses aim to offset the fees charged by credit card companies, which can be particularly burdensome for small and medium-sized enterprises.

Understanding the Mechanics of Dual Pricing Models

For small business owners, comprehending the nuances of dual pricing models is crucial. These models not only offer a pathway to better manage the often significant credit card processing fees but also provide a transparent pricing structure for customers. In a market where every dollar counts, understanding and effectively implementing a dual pricing strategy can be the key to maintaining profitability while keeping prices fair and competitive.

Benefits of Dual Pricing for Small Businesses

The adoption of offering a dual pricing strategy can be particularly beneficial for small businesses. This model allows these businesses to pass the additional costs of credit card processing directly to those who choose to use this payment method, while rewarding customers who pay with cash or debit cards through lower prices. Not only does this help in mitigating the financial impact of credit card fees, but it also encourages a diverse payment ecosystem where customers have the freedom to choose the payment method that best suits their preferences.

Dual Pricing Credit Card Processing: Unpacking the Basics

In the world of small business transactions, dual pricing in credit card processing emerges as a novel and increasingly popular approach. At its core, dual pricing is a pricing strategy where businesses set two different prices for the same product or service: one for cash payments and another for credit card payments. This strategy is not just a clever financial move; it’s a response to the varied payment preferences of today’s consumers.

The Mechanics of Dual Pricing for Merchant Services

Under a dual pricing model, a business typically advertises two prices. The first is the regular price, which applies to transactions made using a credit card. This price often includes additional costs associated with credit card processing fees. The second is a discounted price for customers who opt to pay with cash. This discount effectively acts as an incentive for cash payments, reducing the transactional load on credit card processors and, subsequently, the fees the business incurs.

Impact on Payment Processing Costs and Pricing Strategy

Adopting a dual pricing model can significantly influence a business’s overall payment processing strategy. By incentivizing cash payments, businesses can reduce the volume of credit card transactions, thereby lowering their total processing fees. This can be particularly advantageous for small businesses where margins are tight and every dollar saved counts. Furthermore, dual pricing allows for more transparent pricing strategies, making customers more aware of the actual costs associated with different payment methods.

Accommodating Credit and Debit Card Transactions

Dual pricing is a flexible model that accommodates both credit and debit card transactions. While the primary focus is often on credit card transactions due to higher processing fees, businesses can extend the model to include debit cards. This inclusivity ensures that customers who prefer cashless transactions are not disadvantaged, while still promoting cash payments where feasible.

Understanding the Dual Pricing Program

Structuring a Dual Pricing Program

Implementing a dual pricing program requires careful planning and clear communication. Businesses must decide on the differential between the cash price and the credit card price. This difference is often a percentage of the total cost, reflecting the processing fee charged by credit card companies. It’s important that these rates are set in a way that covers the additional costs without alienating customers.

Clarifying Pricing Terms

Clear signage and communication are crucial in a dual pricing strategy. Customers should easily understand the difference between the cash price and the credit card price. This transparency helps in managing customer expectations and avoids potential confusion at the point of sale. For instance, a product might be advertised with a sign stating: “Price: $20 (Cash) / $20.75 (Credit Card).” This direct approach ensures customers are fully informed about their payment options and the associated costs.

By navigating these aspects effectively, small business owners in Canada can make the most out of dual pricing, balancing customer convenience with cost-effective payment processing.

Benefits of a Dual Pricing Model for Small Businesses

The adoption of a dual pricing model can be a game-changer for small businesses, particularly in the bustling realms of brick-and-mortar retail and the restaurant industry. This approach isn’t just about diversifying payment options; it’s a strategic move that brings tangible benefits to the business and its customers.

Cost-Saving Aspects

One of the most compelling advantages of dual pricing is its potential to substantially reduce processing and program costs. Credit card transactions typically involve fees, which can eat into the profits of small businesses. By encouraging customers to pay with cash through a lower price point, businesses can decrease the volume of costlier credit card transactions. This shift can lead to significant savings, especially for businesses with a high frequency of small transactions.

Enhanced Pricing Transparency

Dual pricing also champions the cause of transparency in pricing. It demystifies the often-hidden costs associated with credit card transactions. By clearly displaying the cash and credit card prices side by side, businesses can educate their customers about the real costs of different payment methods. This transparency not only builds trust but also empowers customers to make informed decisions based on their preferred payment methods.

Real-World Success Stories

The effectiveness of dual pricing is not just theoretical; it’s evidenced by numerous success stories across various sectors. For example, many brick-and-mortar retailers and restaurants have adopted this model to great effect. These businesses often find that dual pricing not only reduces their processing costs but also attracts customers who appreciate the savings offered by cash payments. This approach can be particularly effective in areas with high foot traffic, where the convenience of cash payments is often coupled with a desire for quicker transactions.

The Dual Pricing Advantage

The Incentive of Lower Cash Prices

At the heart of the dual pricing model is the concept incentivizing the customer with the option to pay with cash or debit. This isn’t just a marketing gimmick; it’s a strategic move to offer tangible benefits for choosing cash over credit. By setting a lower cash price for each product or service, businesses create a direct incentive for customers to use cash. This incentive can be particularly appealing in price-sensitive markets, where even a small discount can sway consumer choices.

Success Stories of Cash Discounts

Numerous small businesses have harnessed the power of cash discounts with remarkable success. For instance, a local café might offer a 5% discount on all cash purchases. This simple strategy can lead to an increase in cash transactions, reducing the café’s reliance on costlier card payments. Similarly, a family-run boutique could implement a dual pricing model during high-traffic seasons, like holidays, to encourage more cash purchases, thereby optimizing their profit margins.

In each of these cases, the dual pricing model has proven to be more than just a financial strategy; it’s a tool for building customer relationships based on transparency and mutual benefit. By clearly communicating the advantages of cash and debit card payments, these businesses not only save on costs but also foster a sense of goodwill and trust with their customers.

Navigating Credit Card Processing Fees with Dual Pricing

In the intricate landscape of small business operations, understanding and managing credit card processing fees is a critical aspect of financial health. For Canadian businesses, these fees can be a substantial overhead, especially when not strategically managed. This is where the dual pricing model comes into play, offering an innovative approach to handle these fees.

Understanding Credit Card Processing Fees in Canada

Credit card processing fees in Canada vary, but they typically include a blend of percentage-based transaction fees, flat per-transaction charges, and monthly account fees. These fees can differ based on the card issuer, the type of credit card used (e.g., standard, premium), and the payment processor. Fees in Canada range from 0.92% to over 3%. For a small business, these fees can quickly accumulate, particularly with a high volume of credit card transactions.

Effectiveness of Dual Pricing in Fee Management

By adopting a dual pricing model, businesses can effectively navigate these processing fees. This model allows businesses to offset the additional costs associated with credit card transactions by charging a slightly higher price for these payments compared to cash. It’s a straightforward yet effective method: customers who choose to pay with credit cards cover the extra costs, thus easing the financial burden on the business.

Dual Pricing vs. Surcharge: A Cost Comparison

In the nuanced world of payment processing, small business owners often find themselves weighing different strategies to manage costs while maintaining customer satisfaction. Two such strategies – dual pricing and surcharging – are commonly considered, each with its unique approach to handling the expenses associated with credit card transactions. Understanding the differences in cost implications between these two methods is crucial for making an informed decision that aligns with a business’s financial and customer service goals.

The Concept of Dual Pricing

Dual pricing, as previously discussed, involves setting two different price points for a product or service: one for cash and debit payments and a higher one for credit card payments. This model is transparent in its approach, clearly delineating the cost difference between payment methods. Customers are given a straightforward choice – pay with cash and save, or use a credit card and accept the slightly higher price. This strategy is particularly effective in environments where cash payments are still prevalent and can lead to significant savings in credit card processing fees for the business.

Understanding Surcharging

On the other hand, surcharging involves adding an additional fee to transactions made with a credit card, over and above the regular price of the product or service. This surcharge is specifically intended to cover the cost of processing the credit card payment. While surcharging can also help a business recoup the costs associated with credit card transactions, it differs from dual pricing in that the extra charge is applied only at the point of sale and is not reflected in the advertised price.

Cost Comparison: Dual Pricing vs. Surcharge

When comparing the cost implications of dual pricing and surcharging, several factors come into play:

- Transparency: Dual pricing is often perceived as more transparent since customers are aware of the price differences upfront. Surcharges, however, require clearly communicate at the businesses point of entry and at the point of sale. Surcharging also requires that merchants register themselves with the card brands, prior to implementing this type of pricing strategy.

- Customer Perception: Some customers may view surcharges negatively, as they can feel like unexpected penalties for using credit cards. In contrast, dual pricing is often seen as offering a discount for cash payments, which can be perceived more positively.

- Regulatory Compliance: It’s important to consider the legal aspects of both strategies. In some jurisdictions, surcharging may be subject to specific regulations or even prohibitions, whereas dual pricing is generally more widely accepted. Quebec is a great example in Canada, of a jurisdiction that does not allow surcharging, but dual pricing is a viable processing program.

Both dual pricing and surcharging offer viable ways for businesses to handle the costs associated with credit card processing. The choice between the two should be based on a thorough understanding of their cost implications, how they align with customer preferences, and their compatibility with regional regulations. For many small businesses, the key lies in finding a balance that minimizes processing fees while maintaining a positive customer experience.

Comparing Credit Card and Cash/Debit Transaction Costs

Analyzing the Cost Differential

The cost differential between credit card and cash transactions is significant. Credit card payments involve processing fees that can range anywhere from 0.92% to over 3% per transaction. Cash transactions, in contrast, have no such fees, making them inherently more cost-effective for the business. This differential is the driving force behind the dual pricing model.

The Role of Payment Processors and Merchant Accounts

Payment processors and merchant accounts play a pivotal role in supporting a dual pricing model. They are the intermediaries that handle the transaction processing, whether for debit or credit. For dual pricing to work seamlessly, these systems must be capable of distinguishing between different payment methods and applying the appropriate pricing structure. This requires not just technical capability but also a level of flexibility in the processing system to accommodate the unique pricing model.

In conclusion, for small business owners in Canada, navigating credit card processing fees doesn’t have to be a daunting task. By understanding and implementing a dual pricing model with Rescue Payments, businesses can create a more balanced approach to handling transaction costs, ultimately leading to a more sustainable and profitable operation.

Implementing a Dual Pricing Strategy: Steps and Considerations

For small business owners in Canada looking to navigate the complexities of payment processing while maintaining profitability, implementing a dual pricing strategy can be a savvy move. However, this strategy requires thoughtful planning and awareness of several key factors.

Legal and Regulatory Considerations

First and foremost, it’s crucial to understand the legal and regulatory landscape surrounding dual pricing in Canada. Regulations may vary by province, and it’s essential to ensure compliance with both national and local laws. This includes adhering to regulations set by credit card companies and payment processors. The good news, Rescue handles all of that for you!

Essential Elements of a Dual Pricing Strategy

To successfully implement a dual pricing strategy, there are several critical components to consider:

- Upgraded Point-of-Sale (POS) Systems: Your payment terminal must be capable of handling two pricing structures seamlessly. It should automatically apply the appropriate price based on the payment method, ensuring accuracy and efficiency at checkout.

- Reliable Merchant Services: Partnering with a merchant service provider, like Rescue Payments, that understands and supports dual pricing is crucial.

- Clear Signage and Communication: Transparency is key in a dual pricing model. Clear, visible signage that explains the pricing difference for cash and credit card payments helps in maintaining customer trust and satisfaction. This includes displaying both prices on product labels, menus, or digital displays.

The Importance of a Payment Terminal that Supports Dual Pricing

A devices that accommodates dual pricing is more than just a technical requirement; it’s the backbone of this strategy. The right system will not only manage different pricing tiers but also provide valuable data insights, such as the ratio of cash to credit card sales, helping you fine-tune your pricing strategy over time.

A robust and adaptable device is the linchpin in the successful implementation of a dual pricing strategy. Such a system should:

- Accurately Handle Different Pricing Structures: The terminal must seamlessly switch between debit and credit card pricing, ensuring accuracy in billing and a smooth transaction process.

- Offer Comprehensive Reporting: Detailed reporting capabilities allow businesses to track sales trends, understand the proportion of cash versus credit transactions, and adjust their strategy accordingly.

- Be User-Friendly: The system should be intuitive and easy to use, minimizing errors and streamlining the checkout process for both employees and customers.

Choosing the Right Payment Processing Partner

Criteria for Selecting a Payment Processor

When selecting a payment processor to support your dual pricing model, consider these key criteria:

- Compatibility with Dual Pricing: Ensure the processor is familiar with and can effectively support a dual pricing model.

- Fee Structure Transparency: Look for processors with clear, transparent fee structures. Understanding the costs associated with each transaction type is crucial for effective dual pricing.

- Reliability and Support: Choose a processor known for reliable service and excellent customer support, as this will be crucial in addressing any issues that arise.

Key Takeaways

As we wrap up our exploration of the dual pricing strategy for credit card processing, it’s important to consolidate the key insights and takeaways for small business owners in Canada. This strategy, while potentially beneficial, requires careful consideration and planning to implement effectively.

Main Benefits of Implementing a Dual Pricing Program

- Cost Efficiency: One of the most significant advantages of dual pricing is the potential reduction in processing fees associated with credit card transactions. By encouraging cash and debit card payments through discounted pricing, businesses can significantly lower these overhead costs.

- Increased Transparency: Dual pricing promotes a transparent pricing structure. Customers appreciate knowing the cost differences between cash and credit card payments, fostering a sense of fairness and trust.

- Flexibility in Payment Options: Implementing a dual pricing model provides customers with the flexibility to choose their preferred payment method, enhancing customer satisfaction and potentially driving more sales.

- Competitive Edge: For businesses in competitive markets, offering dual pricing can be a unique selling point, distinguishing them from competitors who may not offer such benefits (or may not take credit card at all).

FAQs on Dual Pricing for Small Businesses

As small business owners in Canada consider the adoption of a dual pricing model for credit card processing, several common questions arise. Understanding these aspects is crucial for making informed decisions that align with business goals and customer needs.

How Does Dual Pricing Impact Both Credit and Debit Card Payments?

Dual pricing primarily targets the differential in processing fees between cash, credit, and debit card transactions. While credit card transactions always incur higher processing fees due to the costs charged by credit card companies, debit card fees always lower. Under a dual pricing model, the price for credit card payments might be higher to offset these fees, while the price for debit card transactions could be set closer to the cash price, recognizing the lower cost of processing these payments. This strategy allows businesses to more accurately reflect the true cost of each payment method.

How Does a Business Owner Decide Whether Dual Pricing Is the Right Choice for Their Operations?

Deciding whether to implement a dual pricing strategy requires a thorough assessment of several factors:

- Customer Base and Payment Preferences: Understand the preferred payment methods of your customer base. If a significant portion prefers cash or debit, dual pricing might be more effective.

- Volume of Credit Card Transactions: Assess the proportion of credit card transactions and the associated processing fees. Higher volumes might mean greater savings with dual pricing.

- Competitive Landscape: Consider the pricing strategies of competitors. Being the only business with dual pricing in the area might impact customer perception.

- Operational Complexity: Evaluate whether your current systems, like POS and accounting software, can handle dual pricing without significant complications.

- Regulatory Compliance: Ensure that the dual pricing model complies with local and national regulations, as well as the policies of credit card companies.

By carefully considering these factors, business owners can determine whether the benefits of dual pricing align with their operational goals and customer needs. This strategic decision should balance potential cost savings with the overall impact on customer experience and business operations.

Conclusion

As we conclude our exploration of dual pricing models for small businesses in Canada, it’s clear that this strategy presents both significant opportunities and considerations. Dual pricing isn’t just a financial tactic; it’s a reflection of a business’s adaptability to evolving market conditions and consumer preferences.

Adopting a dual pricing model can be a testament to a business’s commitment to providing options that cater to different customer preferences. In today’s diverse market, offering customers the choice between cash, debit and credit – with transparent pricing for each – can enhance their shopping experience, showing that your business values their needs and preferences.

Dual pricing models offer an intriguing avenue for small business owners in Canada to optimize their payment processing systems. While it demands careful consideration and strategic implementation, its potential benefits in cost savings, customer transparency, and operational efficiency make it a worthwhile consideration. As with any strategic business decision, it’s crucial to weigh the pros and cons, stay informed about legal and regulatory requirements, and continually assess its impact on your business and customers. With these factors in mind, dual pricing can be a valuable addition to your business’s financial toolkit.